×

For a sector that is in the midst of a housing affordability crisis that will worsen if increases in housing supply remain anemic while demand increases as expected, we have a hopeful vision of four ways we can help you address this crisis and basic supply and demand mismatch.As Brian Brooks, chief legal officer at the cryptocurrency company Coinbase (and former Fannie Mae general counsel), outlined the housing sector’s basic supply and demand mismatch during his speech, the rate of home construction today is less than half of what it was before the 2008 crisis, with just seven homes being built for every 1,000 adults. Conversely, the household formation rate is twice what it was immediately following the 2008 crisis, with about 1.2 million new households forming over the next few years, compared with the 600,000 households formed between 2010 and 2015. Essentially, we are seeing half the historic rate of household construction and double the rate of household formation. That’s why even middle-income residents end up as renters in high-cost cities such as San Francisco, where the average home price is $1.3 million, or in Washington, DC, where the average price is $800,000. We work with affordable housing providers on pertinentprojectsby enabling them with machine learning AI enabled solutions toastutely learn from data rather than through explicit programming. However, machine learning is not a simple process We utilize machine learning to iteratively learn from data to improve, describe data, and predict outcomesin helping you make sense of your data to equip you with the information you need to provide personalized services to your residents.

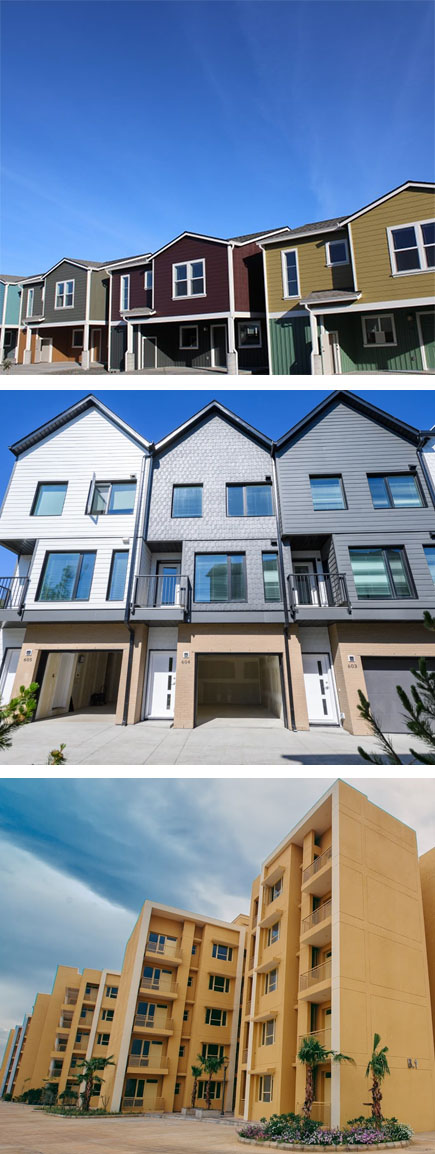

We offer a few ways we address housing Affordability Crisis:

Reducing the cost of supplying new housing with the aid of 3D printing and modular housing construction by building parts of the house in a factory and then ships the parts to the site for assembly.

Expanding access to capital and improving risk predictions methods with the rise of AI and blockchain technology to help you better predict risk by allowing you to create more accurate models and by delivering more data to plug into these models to better understand what is actually relevant to loan performance.